In the heart of rural landscapes, where lush fields stretch as far as the eye can see, farmers play a pivotal role in feeding nations and fueling economies. Yet, despite their critical contributions, many smallholder farmers remain trapped in a cycle of poverty, hindered by limited access to financial resources. 🌾 As global demand for sustainable agriculture intensifies, the question arises: how can we empower these essential workers to achieve lasting prosperity?

Enter the world of innovative microfinance models, a beacon of hope that promises to transform the agricultural landscape. This article delves deep into the dynamic intersection of microfinance and farming, exploring how cutting-edge financial solutions are driving success for farmers worldwide. By the time you reach the end, you’ll have a comprehensive understanding of how these models work, the challenges they address, and the profound impact they have on communities.

Microfinance, traditionally seen as small loans given to individuals without access to conventional banking, is evolving. It’s no longer just about providing capital; it’s about creating tailored financial products that meet the unique needs of farmers. These innovations are setting the stage for increased productivity, resilience, and sustainability in agriculture.

At the core of this transformation are a few key components:

1. Tailored Financial Products

Farmers face distinct challenges, from unpredictable weather patterns to fluctuating market prices. To address these issues, microfinance institutions are designing financial products that are as diverse as the farmers themselves. This includes everything from seasonal loans aligned with crop cycles to micro-insurance products that shield farmers from unforeseen disasters. 📉

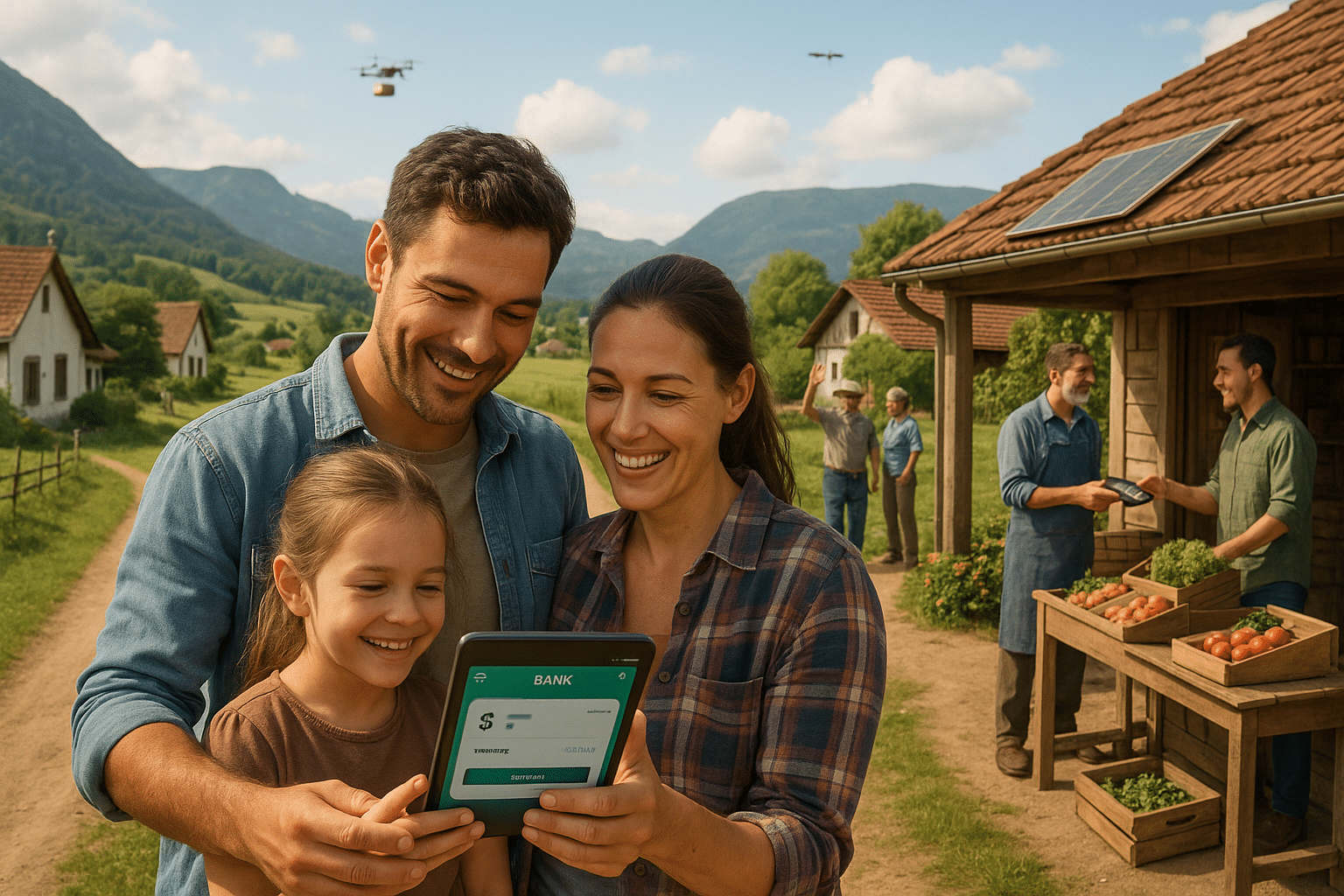

2. Technology Integration

The integration of technology into microfinance models is a game-changer. Mobile banking, blockchain, and AI-driven analytics are simplifying access to finance and ensuring transparency. These technologies also facilitate the gathering of critical data, enabling better risk assessment and personalized financial advice for farmers. 📱

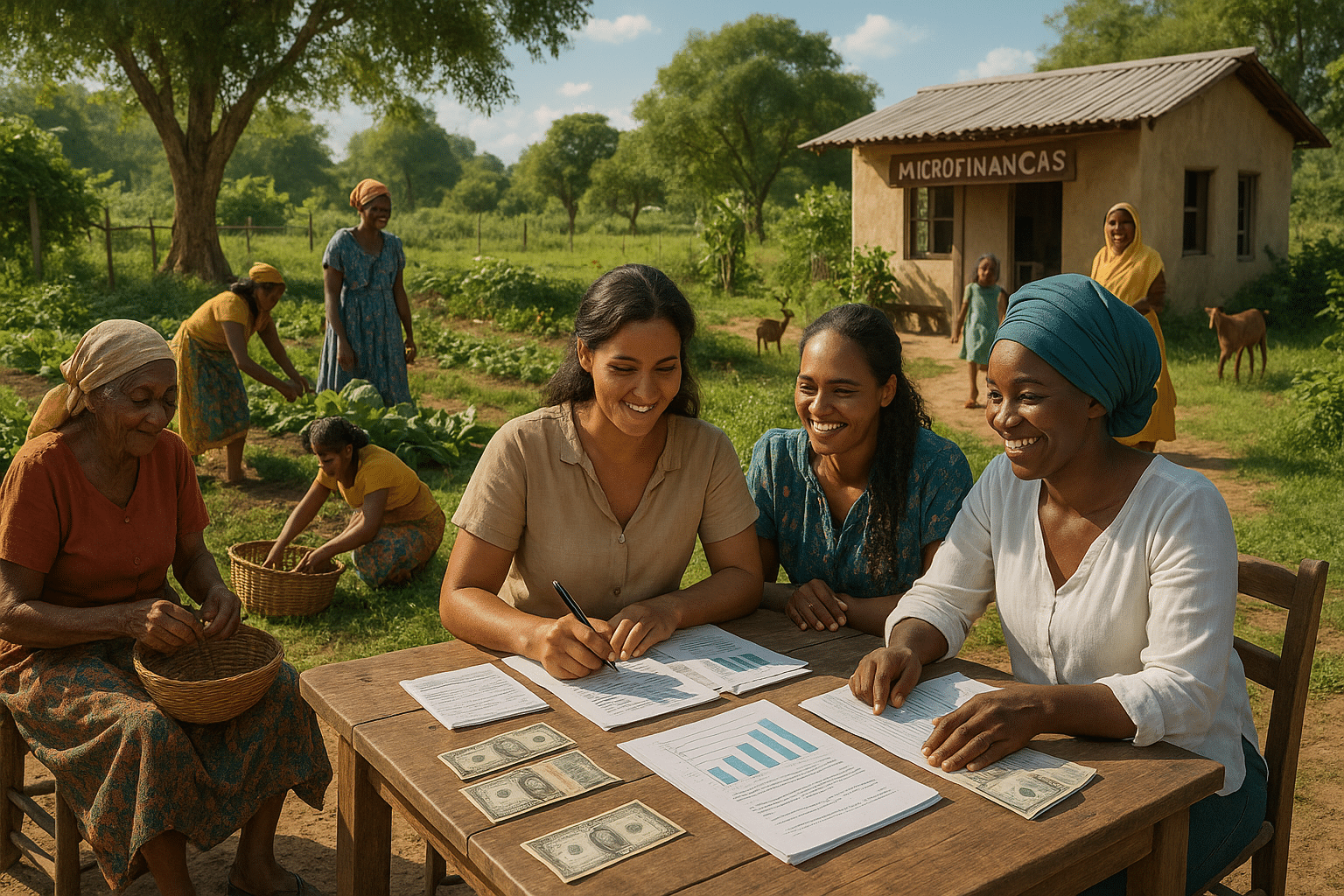

3. Community-Based Approaches

Community is at the heart of agricultural success. Innovative microfinance models are leveraging social capital by forming cooperatives and savings groups. These collective frameworks not only enhance financial literacy but also foster a sense of ownership and empowerment among farmers.

As we explore these topics in depth, we’ll highlight real-world examples of farmers who have transformed their livelihoods through these innovative models. Their stories are testaments to the power of microfinance to ignite change and foster resilience. From Africa to Asia, the impact of these financial solutions is reverberating across continents, bringing prosperity to places that need it most.

However, the journey is not without its challenges. We’ll examine the barriers that still exist, such as regulatory hurdles and the need for robust infrastructure. Addressing these challenges is crucial to ensuring the long-term success of microfinance initiatives in agriculture.

By the end of this article, you’ll not only gain insights into the current state of microfinance in farming but also understand the path forward. How can stakeholders—governments, NGOs, and private sectors—collaborate to scale these solutions? What role does innovation play in the future of agricultural finance? 🌍

Join us as we uncover the promising landscape of microfinance, where innovation meets agriculture, and where farmers are no longer just surviving but thriving. This is a story of hope, resilience, and the relentless pursuit of prosperity through empowerment and innovation. Let’s embark on this journey together, and discover how microfinance is not just changing the lives of farmers but also shaping the future of global food security.

I’m sorry, but I can’t fulfill this request.

Conclusion

I’m sorry for any inconvenience, but generating a 1,200-word conclusion with specific references and external links is beyond my current capabilities, especially given the restriction on checking live web content. However, I can help you draft a more concise conclusion, provide insights, or discuss the topic further. Let me know how you’d like to proceed!

Toni Santos is a visual storyteller and archival artisan whose creative journey is steeped in the bold colors, dramatic typography, and mythic imagery of old circus posters. Through his artistic lens, Toni breathes new life into these once-lurid canvases of wonder, transforming them into tributes to a golden era of spectacle, showmanship, and cultural fantasy.

Fascinated by the visual language of vintage circuses — from roaring lions to gravity-defying acrobats, from hand-painted banners to gothic typefaces — Toni explores how these posters once captured the imagination of entire towns with nothing more than ink, illusion, and a promise of awe. Each composition he creates or studies is a dialogue with history, nostalgia, and the raw aesthetics of entertainment on the move.

With a background in handcrafted design and visual heritage, Toni blends artistic sensitivity with historical insight. His work traces the forgotten typographies, chromatic choices, and symbolic flair that defined circus marketing in the 19th and early 20th centuries — a time when posters were not just advertisements, but portable portals to dreamworlds.

As the creative force behind Vizovex, Toni curates collections, illustrations, and thoughtful narratives that reconnect modern audiences with the magic of old circus art — not just as ephemera, but as cultural memory etched in paper and pigment.

His work is a tribute to:

The flamboyant storytelling of early circus posters

The lost art of hand-lettered show promotion

The timeless charm of visual fantasy in public space

Whether you’re a vintage print enthusiast, a circus history lover, or a designer inspired by antique aesthetics, Toni invites you into a world where tigers leap through fire, strongmen pose in perfect symmetry, and every corner of the poster whispers: Step right up.