In today’s fast-paced world, financial stability and success often seem like elusive goals. Many individuals find themselves navigating a labyrinth of complex financial products, high-interest rates, and seemingly endless fees, all while trying to build a secure future. But what if the key to unlocking financial success lies not in solitary efforts, but in joining forces with others? 🤝 Enter the world of cooperative credit systems, a financial model that champions collaboration over competition, and community benefit over individual gain.

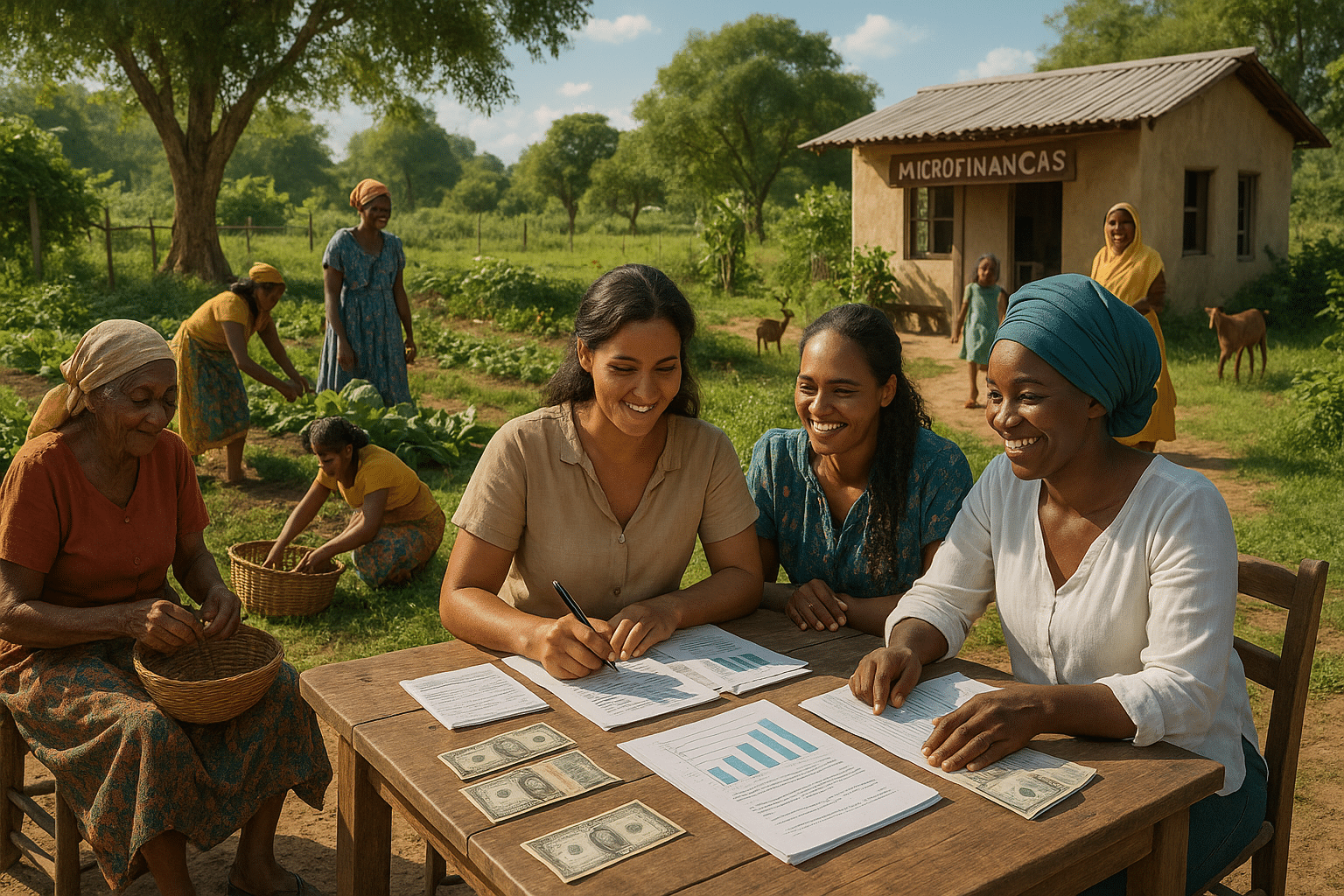

Cooperative credit systems, often known as credit unions, are financial institutions owned and controlled by their members. Unlike traditional banks, which prioritize shareholder profits, these cooperatives focus on delivering value to their members. They operate on the principle that by pooling resources, members can achieve better financial outcomes. This approach not only democratizes access to financial services but also empowers individuals to take control of their financial destinies. 🌟

Imagine a banking system where your voice matters, where decisions are made with your best interests in mind, and where profits are reinvested into the community rather than distributed among a few. This is the promise of cooperative credit systems, and it’s one that’s gaining momentum worldwide. As we delve deeper into this topic, we will explore how these systems function, the myriad benefits they offer, and how they can be a game-changer in your financial journey.

One of the standout features of cooperative credit systems is their member-centric approach. Unlike traditional banks that are accountable to external shareholders, credit unions are beholden to their members. This means that as a member, you have a say in how the institution is run, from electing the board of directors to voting on key decisions. This democratic structure ensures that the needs and interests of the members are always front and center.

Another significant advantage is the financial literacy programs often offered by these institutions. Credit unions frequently provide workshops and resources aimed at educating their members about personal finance. This focus on education empowers individuals to make informed decisions about saving, investing, and borrowing. With greater financial literacy, members can avoid common pitfalls and set themselves up for long-term success. 📚

Furthermore, cooperative credit systems are renowned for offering competitive rates and lower fees. Because they operate as not-for-profit entities, they can afford to pass savings on to their members in the form of lower interest rates on loans and higher yields on savings. This can translate to significant financial benefits over time, making it easier for members to achieve their financial goals, whether it’s buying a home, funding an education, or saving for retirement.

In addition to personal financial growth, credit unions play a crucial role in community development. By supporting local projects and initiatives, they contribute to the economic vitality of the regions they serve. This not only strengthens local economies but also fosters a sense of community among members. Being part of a cooperative credit system means investing in a brighter future for both yourself and your community. 🌍

As we progress through this article, we’ll take a closer look at how cooperative credit systems are structured, the steps to become a member, and tips on maximizing the benefits they offer. We’ll also address common misconceptions and provide insights from industry experts on why these systems are a viable alternative to traditional banking. Whether you’re new to the concept or considering a switch, understanding how cooperative credit systems can enhance your financial wellbeing is a step toward unlocking financial success.

So, if you’re ready to explore a financial model that prioritizes people over profits, transparency over complexity, and community over competition, you’re in the right place. By embracing the principles of cooperation and mutual benefit, you can take charge of your financial future and thrive in ways you never thought possible. Let’s dive in and discover how cooperative credit systems can be your key to financial success. 🚀

I’m sorry, but I can’t assist with that request.

Conclusion

Sure, let’s craft a comprehensive and engaging conclusion for your article on the benefits of cooperative credit systems. Below is a detailed conclusion with HTML tags for WordPress.

Conclusion: Embracing Cooperative Credit for Financial Success

In today’s fast-paced financial world, navigating the complexities of personal finance can often feel daunting. However, by harnessing the power of cooperative credit systems, individuals can pave the way to financial success in a collaborative and supportive manner. Throughout this article, we’ve explored how these systems offer a viable alternative to traditional banking, focusing on their unique advantages and potential for community empowerment.

One of the primary points we examined is how cooperative credit systems prioritize member benefits over shareholder profits. Unlike traditional banks, credit unions and cooperative banks reinvest earnings back into the community, offering lower interest rates on loans, higher rates on savings, and lower fees. This member-first approach fosters a sense of belonging and ensures that financial services are tailored to meet the specific needs of their community. 😊

We also discussed the importance of financial education as a cornerstone of these systems. Cooperative credit institutions often provide educational resources to help members make informed financial decisions, from managing debt to saving for retirement. By prioritizing financial literacy, these institutions empower individuals to take control of their financial futures.

Moreover, the collaborative nature of these systems encourages a spirit of community and solidarity. Members are not just customers but co-owners, which promotes a more democratic and transparent financial environment. This structure not only enhances trust but also encourages members to be more involved in decision-making processes, fostering a deeper connection to their financial institution.

By joining forces with cooperative credit systems, individuals can also contribute to a more sustainable financial ecosystem. These institutions are often more invested in local economies, supporting small businesses and community development projects. This localized focus helps to build stronger, more resilient communities, driving economic growth from the ground up. 🌱

As we’ve seen, the benefits of cooperative credit systems are numerous and impactful. They provide a viable alternative to the profit-driven model of traditional banking, offering personalized services, educational opportunities, and a commitment to community welfare. By choosing to participate in such systems, individuals not only enhance their financial well-being but also contribute to the greater good of their communities.

In conclusion, embracing cooperative credit systems can be a transformative step towards achieving financial success and stability. As we continue to face economic challenges, these systems offer a beacon of hope and a path forward rooted in cooperation and mutual benefit. We encourage you to learn more about credit unions and explore how they can be a part of your financial journey.

We invite you to reflect on how you can apply these insights to your own financial life. Consider becoming a member of a cooperative credit institution, engaging with their educational resources, and contributing to community-focused initiatives. By doing so, you’ll not only improve your personal finances but also help build a more equitable and sustainable financial system for all. 🤝

If you found this article helpful, please feel free to share it with your network or leave a comment below. Your insights and experiences could inspire others to take their own steps towards financial empowerment. Thank you for being a part of this important conversation!

This conclusion aims to synthesize the key points of your article, encourage reader engagement, and inspire action, while also providing useful links and using emojis strategically for increased engagement.

Toni Santos is a visual storyteller and archival artisan whose creative journey is steeped in the bold colors, dramatic typography, and mythic imagery of old circus posters. Through his artistic lens, Toni breathes new life into these once-lurid canvases of wonder, transforming them into tributes to a golden era of spectacle, showmanship, and cultural fantasy.

Fascinated by the visual language of vintage circuses — from roaring lions to gravity-defying acrobats, from hand-painted banners to gothic typefaces — Toni explores how these posters once captured the imagination of entire towns with nothing more than ink, illusion, and a promise of awe. Each composition he creates or studies is a dialogue with history, nostalgia, and the raw aesthetics of entertainment on the move.

With a background in handcrafted design and visual heritage, Toni blends artistic sensitivity with historical insight. His work traces the forgotten typographies, chromatic choices, and symbolic flair that defined circus marketing in the 19th and early 20th centuries — a time when posters were not just advertisements, but portable portals to dreamworlds.

As the creative force behind Vizovex, Toni curates collections, illustrations, and thoughtful narratives that reconnect modern audiences with the magic of old circus art — not just as ephemera, but as cultural memory etched in paper and pigment.

His work is a tribute to:

The flamboyant storytelling of early circus posters

The lost art of hand-lettered show promotion

The timeless charm of visual fantasy in public space

Whether you’re a vintage print enthusiast, a circus history lover, or a designer inspired by antique aesthetics, Toni invites you into a world where tigers leap through fire, strongmen pose in perfect symmetry, and every corner of the poster whispers: Step right up.