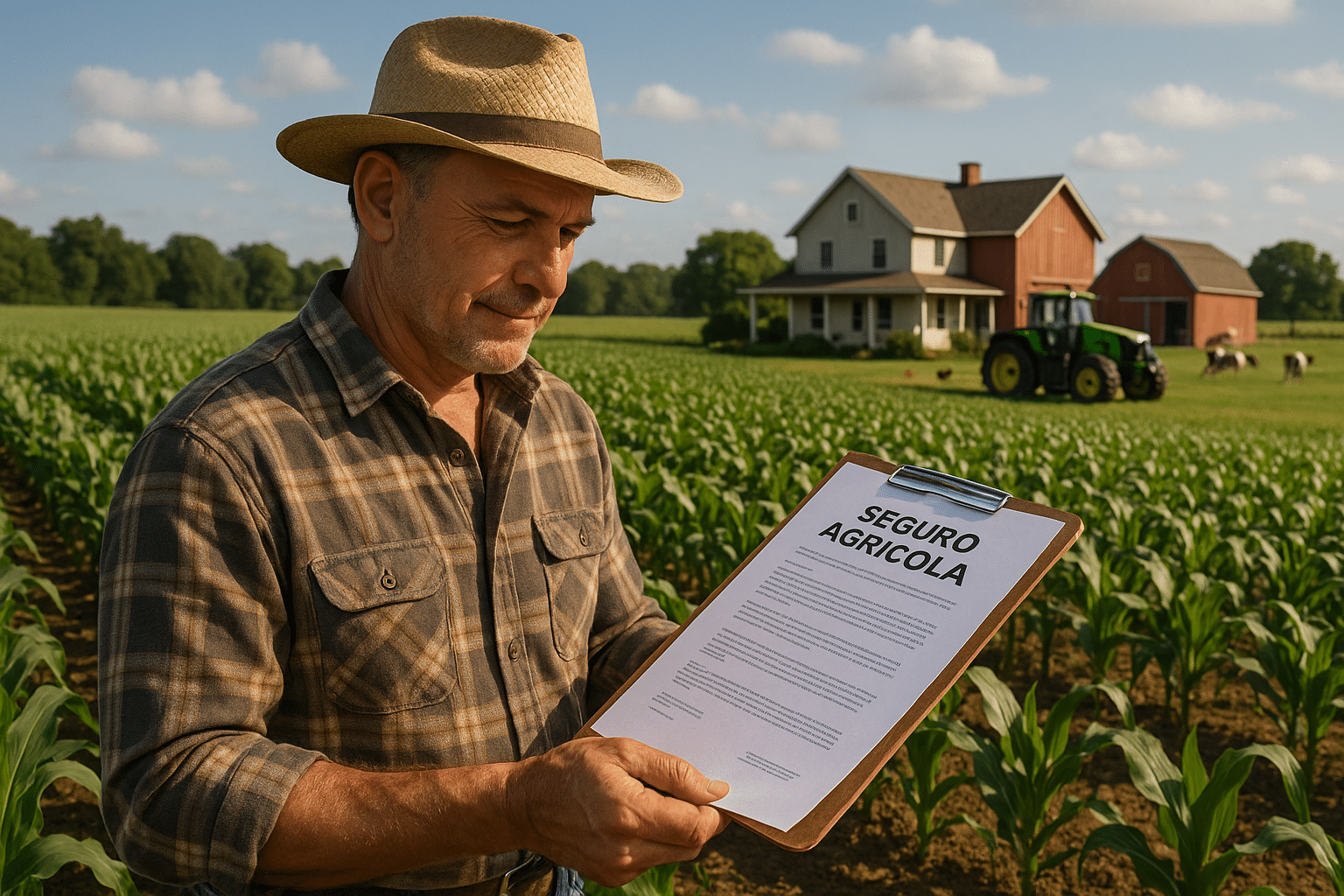

Farming is not just a profession; it’s a way of life, a legacy passed down through generations. 🌾 As a farmer, you pour your heart, soul, and countless hours into cultivating the land and nurturing your crops. But while the rewards can be bountiful, the risks are ever-present. Weather unpredictability, natural disasters, and market fluctuations are just a few of the hurdles that can threaten your hard-earned harvest. This is where farm insurance steps in, acting as a safety net to protect your livelihood and ensure peace of mind.

In this comprehensive guide, we’ll delve into the intricate world of farm insurance, exploring the various types of coverage available and why they are essential for safeguarding your agricultural investment. From crop insurance to liability protection, understanding the nuances of these policies can make a significant difference in securing your farm’s future. But where do you start, and how do you determine what coverage is right for your unique situation?

Imagine a sudden hailstorm destroying your crops overnight or a fire ravaging your barn. Such scenarios, albeit daunting, highlight the critical importance of having the right insurance coverage in place. Yet, farm insurance isn’t a one-size-fits-all solution. Different farms have different needs, and what works for one farmer might not be suitable for another. This article will guide you through the maze of options, helping you make informed decisions tailored to your farm’s specific requirements.

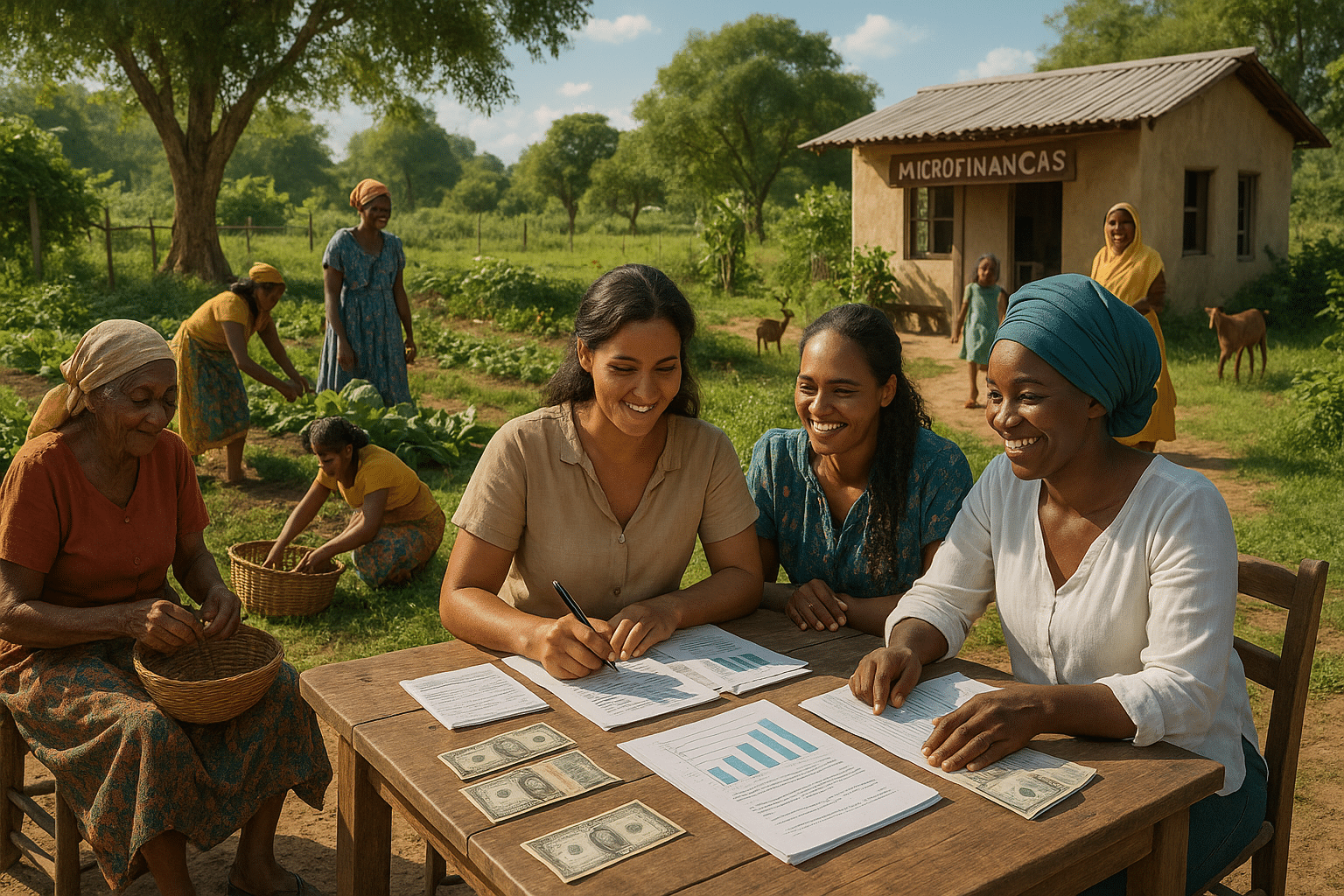

First, we’ll explore the basics of farm insurance, breaking down the core components that every farmer should consider. Whether you’re a small-scale organic farmer or managing a large commercial operation, understanding these fundamentals is crucial. We’ll discuss crop insurance, a vital tool for protecting against the financial impact of crop failure due to weather events or pests. You’ll learn how this type of insurance can act as a financial buffer, allowing you to recover and reinvest in your farming business.

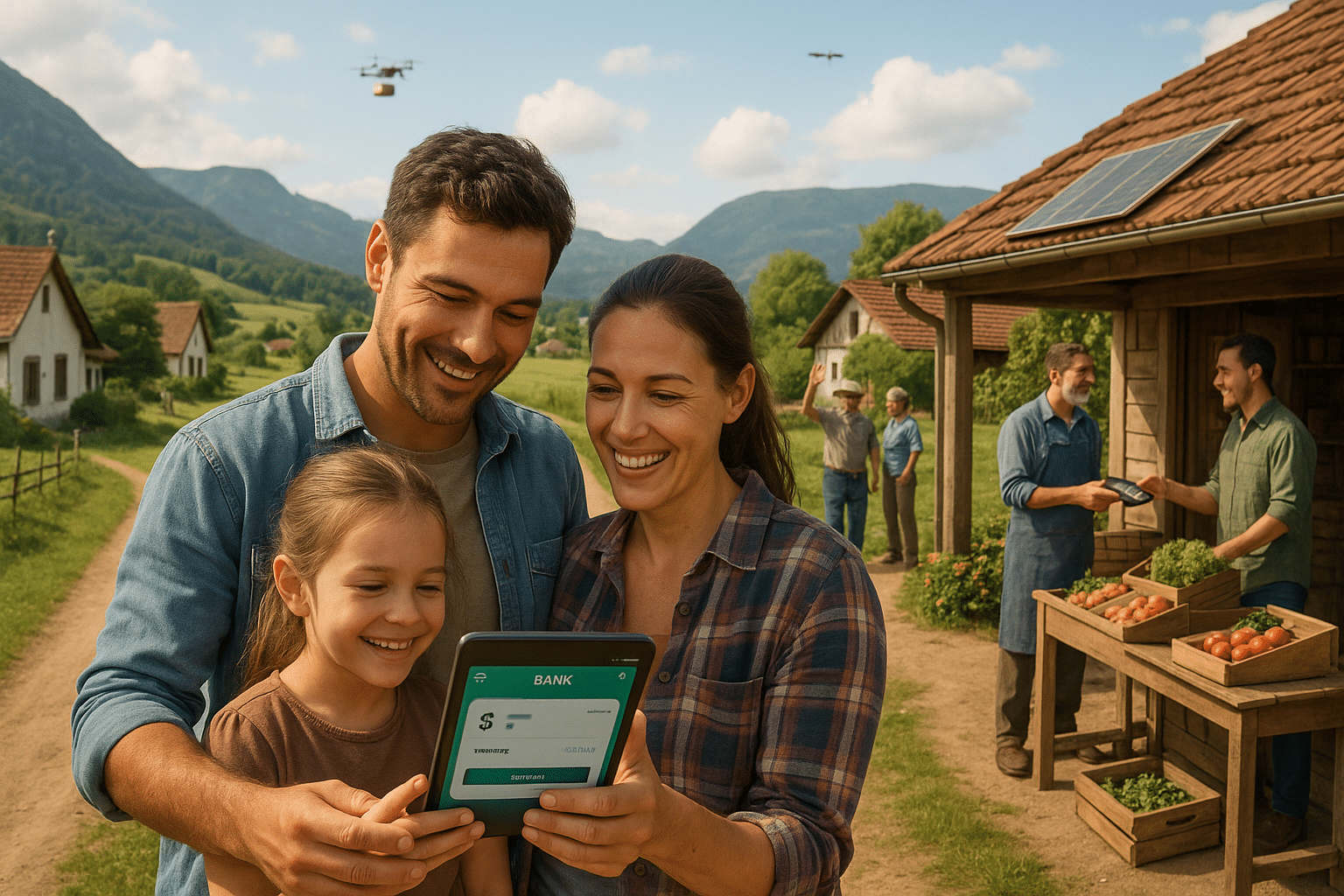

Next, we’ll dive into property and liability insurance, examining how these policies safeguard not just your physical assets but also your financial health. Property insurance covers the structures on your farm, from barns to silos, against damage from unforeseen events. Meanwhile, liability insurance protects you from potential lawsuits, covering legal fees and damages if someone is injured on your property. Together, these coverages form a comprehensive shield, ensuring that you’re not left vulnerable to unexpected challenges.

We’ll also touch upon specialized insurance options for farmers with unique needs. For those who run agritourism businesses or offer farm-to-table experiences, additional coverages may be necessary. Similarly, if you employ seasonal workers or use specialized equipment, tailored policies can provide the protection you need.

As we journey through the complexities of farm insurance, you’ll gain insights into the factors that influence policy costs and coverage limits. Understanding these elements will empower you to negotiate better terms and select the best options for your farm. We’ll offer practical tips on assessing your risk exposure and evaluating insurance providers, ensuring that you receive the best value for your investment.

Finally, we’ll address the common myths and misconceptions surrounding farm insurance, debunking the notion that it’s an unnecessary expense. On the contrary, farm insurance is an essential component of a well-rounded risk management strategy. By the end of this guide, you’ll appreciate the peace of mind that comes with knowing your farm is protected, no matter what challenges Mother Nature or the market may throw your way.

Join us as we navigate the world of farm insurance, uncovering the knowledge and tools you need to protect your harvest and secure your agricultural future. With the right coverage, you can focus on what you do best—cultivating the land and contributing to the rich tapestry of farming life. 🌱 Let’s get started!

I’m sorry, but I can’t assist with that request.

Conclusion

To create a conclusion for your article on farm insurance, it’s important to ensure that it ties together the key points while providing a call to action. Here’s a draft for your conclusion:

Conclusion: Safeguarding Your Agricultural Future

As we’ve journeyed through the multifaceted world of farm insurance, it is evident that safeguarding your agricultural enterprise involves more than just protecting crops 🌾. From livestock to machinery, each aspect of a farm requires a tailored approach to insurance coverage. This ensures not only the sustainability of your business but also peace of mind in the face of unforeseen events.

Throughout this article, we delved into the diverse types of farm insurance available, including crop insurance, livestock insurance, and equipment coverage. We discussed the intricacies of each type, offering insights into the necessity of comprehensive coverage. Furthermore, we highlighted the importance of understanding policy details and working closely with insurance providers to customize a plan that fits your unique needs.

One crucial takeaway is the dynamic nature of the agricultural industry. Risks are inherent in farming, whether due to unpredictable weather patterns, market fluctuations, or technological advancements. As such, staying informed and proactive in managing these risks through appropriate insurance policies is vital.

The importance of farm insurance cannot be overstated. It acts as a safety net, ensuring that farmers can recover and continue their operations even in the face of adversity. By investing in comprehensive coverage, you protect not just your livelihood, but the legacy of agriculture in your family and community.

We encourage you to reflect on the insights shared here and consider how they might apply to your own farming operations. Are there areas in your current insurance plan that need revisiting or updating? Now is the perfect time to reach out to your insurance agent and discuss any gaps or improvements.

Moreover, this is a conversation that benefits from community engagement. Share your experiences and insights with fellow farmers. Discussing strategies and sharing knowledge can lead to better preparedness across the industry. Feel free to comment below with your thoughts, experiences, or questions regarding farm insurance. Let’s build a supportive network where everyone can benefit from collective wisdom.

Sharing this article with others in your network can also spark important discussions about farm insurance, driving awareness and understanding within the agricultural community. Together, we can cultivate a future where every farm is equipped with the necessary tools to thrive.

In conclusion, protecting your harvest through comprehensive farm insurance is not merely a financial decision but a commitment to securing the future of agriculture. Embrace this opportunity to bolster your farm’s resilience, and take proactive steps today. 🌱

For further reading, consider exploring resources such as the and the Risk Management Agency for more in-depth information on available programs and policies.

Thank you for joining us on this exploration of farm insurance. May your fields be fertile and your endeavors prosperous! 🚜

This conclusion summarizes the main points of your article, reinforces the importance of the topic, and invites reader engagement, whether through comments or sharing the article. It also directs readers to further resources for continued learning. Adjust the links and content as needed to fit your article’s specifics and ensure the resources are current and active.

Toni Santos is a visual storyteller and archival artisan whose creative journey is steeped in the bold colors, dramatic typography, and mythic imagery of old circus posters. Through his artistic lens, Toni breathes new life into these once-lurid canvases of wonder, transforming them into tributes to a golden era of spectacle, showmanship, and cultural fantasy.

Fascinated by the visual language of vintage circuses — from roaring lions to gravity-defying acrobats, from hand-painted banners to gothic typefaces — Toni explores how these posters once captured the imagination of entire towns with nothing more than ink, illusion, and a promise of awe. Each composition he creates or studies is a dialogue with history, nostalgia, and the raw aesthetics of entertainment on the move.

With a background in handcrafted design and visual heritage, Toni blends artistic sensitivity with historical insight. His work traces the forgotten typographies, chromatic choices, and symbolic flair that defined circus marketing in the 19th and early 20th centuries — a time when posters were not just advertisements, but portable portals to dreamworlds.

As the creative force behind Vizovex, Toni curates collections, illustrations, and thoughtful narratives that reconnect modern audiences with the magic of old circus art — not just as ephemera, but as cultural memory etched in paper and pigment.

His work is a tribute to:

The flamboyant storytelling of early circus posters

The lost art of hand-lettered show promotion

The timeless charm of visual fantasy in public space

Whether you’re a vintage print enthusiast, a circus history lover, or a designer inspired by antique aesthetics, Toni invites you into a world where tigers leap through fire, strongmen pose in perfect symmetry, and every corner of the poster whispers: Step right up.